Products

Products

The number of new Digital Disruptive Technologies in the market is already large and continues to grow. Sometimes the terms used to describe the products involved can be contradictory and confusing. In this emerging field we often read about terms such as Crypto-Currencies, Robotics and Fintech but, misleading definitions and descriptions can unfortunately be commonplace. Our clients tell us almost universally, that it is not always clear what these technologies are, what they do and what are the differentials between products? This is one of the key areas where we can add value. At Actual Intelligence we are constantly monitoring new technology types, researching functionality and assessing vendors. This enables us to establish what the products actually do and the real-world problems they solve. Our thorough research can determine the most appropriate products from the most suitable vendors and clearly demonstrate how these can be applied to Financial Services to improve clients’ business models. Our research and expertise can then be passed onto our clients and assist them in sorting through the complicated array of available products and vendors.

For detailed information on specific Digital Disruptive Technology products please contacts us and we will be happy to discuss our research and provide information as required. In the mean time, we have included summary pages to give clients a flavour of some of the most commonly talked about technologies in the market.

Intelligent Process Automation

Intelligent Process Automation

Automating the tasks of the human workforce in the professional services sector using intelligent software platforms known as ‘software robots’ to interact with existing software systems and complete business processes in the same way as a human worker in order to fulfil existing business outcomes more efficiently.

We have all seen the use of robotics in the automated production lines of the manufacturing industry and the transformative increases in productivity experienced as a result. In the service industry however, we have traditionally witnessed low levels of automation due to the majority of the work being done by people, often in a manual, ad-hoc and bespoke way. With the advent of new technology we now are seeing the emergence of Intelligent Software Platforms that can replicate the actions of people by interacting with existing software systems through front end user interfaces in much the same way as a human worker. We are beginning to realise the reality of a digitised workforce.

What does it do and how does it work?

At its most basic level, Intelligent Process Automation [IPA] Software records the actions a human worker takes to complete a computer-based business process across existing software applications. The software achieves this by breaking down common business processes into individual steps, and then recording the outcomes, enabling it to automate them as many times as required and at a very rapid rate. As IPA software interacts with existing software systems through the front end user interface, it is relatively straightforward to build and deploy. Given IPA does not require direct integration with base code, its interface is not hindered by the different scripting languages of existing enterprise systems. IPA software is non-invasive and is therefore quick to implement and quick to scale across an Enterprise.

How is process automation intelligent?

The spectrum of Intelligent Software begins with the most basic of automation which is achieved by software commands following a scripted process. This has been common for a number of years to perform tasks within ‘Single IT’ applications. Robotic Process Automation [RPA] software applications take this to a new level by scripting tasks across multiple ‘Single IT’ applications. This enables business processes that span multiple ‘Single IT’ applications to be automated. The next level up in complexity sees technology platforms that can follow algorithmic business rules, which have commonly been termed ‘Autonomics’ and these can perform more complicated tasks requiring multiple outcomes. From then on, we see software applications that have a cognitive ability to ‘learn on-the-fly’ through pattern recognition and reasoning, these can perform very complicated tasks and these are commonly associated to ‘Cognitive Software’ all the way up to ‘Artificial Intelligence’. It’s worth pointing out that these technologies work in different and specific ways, some simply follow scripts and others are trained to be intelligent by human workers, whilst others at the top end of complexity are able to learn by themselves. It is important therefore, to describe these technologies as a spectrum rather than a continuum, as described in the diagram below.

For the purposes of practical business use we are still at the emerging end of this spectrum. Although as the rapid pace of technological development has surprised many industry commentators and experts, it is clear the benefits to be gained from even the simplest automation platforms demands immediate attention. These applications have got many people across a variety of industries hugely optimistic about its use and deployment and experts are calling this out as the next big, significant wave of technological revolution.

What are the benefits?

The benefits of automation have already been proved out in other industries so we can say with some certainty that the following benefits would apply to the Financial Services Industry. The most obvious benefits being:

- Reduced Operating Cost – arising from reduced headcount to complete business processes. The cost of using a software robot has been estimated to be 1/9 of the cost of on-shore FTE and 1/3 of the cost of an off-shore FTE. As the technology matures these differentials will only increase.

- Increased Productivity – delivered by the gains achieved in efficiency from doing the same or more at a reduced operating cost. Most savings in cost will arise from reduced headcount although savings will also be made by monitoring and managing up the performance of remaining business processes.

- Increased Accuracy – of business outcomes by using elements of automation that safeguard against human error in business processes by automatically checking and validating human worker actions and decisions.

- Increase Speed – of processes due to Intelligent Process Automation technology orchestrating systems to complete business processes much faster than human workers.

- Low Installation Costs – of this technology mean it can be quickly deployed compared to historical IT projects and the return on investment can be measured in weeks rather than months.

- Improved Workforce Orchestration – the introduction of automation into business processes allows for more agile allocation of worker resources. Repetitive and time-consuming low value work can be automated leaving residual, complicated high value knowledge work to be allocated to the expert human workforce.

- Increased Agility – of automated business operations means they can generate real-time analytics, alerts and notifications and respond to periodic variations in demand with additional workers, either; humans or robots. Software robots can also be deployed to complete business processes 24/7. Additionally, as enterprises grow, automated business processes can match that growth.

- Greater Oversight – of business processes and outcomes. In digitised operations potential issues and errors can be flagged for senior management attention as those issues arise. Additionally, as predictive technology develops, alerts can be configured for those errors that might arise and major issues can be avoided as a result.

- Improved Insight – into an enterprise’s operations from the improved analytics that can be derived from digitised business processes. These analytics can be made available in real-time or on a periodic basis, giving senior stakeholders better quality insights with which to view operational performance and adapt their business as required.

In addition to the upfront benefits from automation, the enterprise can also make gains from other indirect ‘soft benefits’ of automation.

- Standardisation – of business processes across departments, enterprises and industries will, over time compound the overall benefit from Intelligent Process Automation.

- Improved Performance – where business processes are digitised, the performance of workers is tracked. Given the axiom of what is ‘monitored is managed’ then this will undoubtedly lead to an overall improved level of worker performance.

Understandably concerns have been raised over this form of technology. Some commentators have suggested that the adoption of automation and robotics could spell the demise of humans in the workplace and eventually lead to mass unemployment. This is unlikely to happen in the near-term but, what we can say with some certainty, is that what we will see is the capabilities of human workers being enhanced and indeed augmented by Intelligent Process Automation. We will see situations where human workers will be more productive and can achieve greater things with the same inputs. Their processing power will be boosted and this will empower them to achieve better outputs. Ultimately they will achieve greater fulfilment in the work they do. Indeed, removing the mundane, boring repetitive elements of peoples’ jobs and freeing them up to focus on the more interesting, intellectually challenging and high-value knowledge work will enrich people’s sense of job satisfaction as well as providing many benefits to the Enterprise that employs them.

What are the practical business uses for the Financial Services Industry?

The technology can typically be applied to any computer based task or business process that is currently completed manually by workers using single or multiple software applications.

This relates to business processes that are unique to Financial Services Enterprises such as new account openings, KYC and AML requirements, data management, transaction management and regulatory reporting, to name just a few. What is common to all Financial Institutions is the proliferation of multiple legacy IT systems and traditionally people have been employed to fill in the gaps between these systems to complete business processes. IPA is naturally suited to joining all of these legacy systems together in an end to end automated flow and thereby reduce the human interaction required to complete the business process.

There are also core business functions that are specific to any Enterprise and some of those business processes can be automated: IT Support, Legal and Compliance, HR and Training. Enterprises in professional services industries outside of Financial Services have already begun automating business processes within these functions with great effect.

Over the last few decades we have seen Professional Services Enterprises out-source elements of their business operations to low cost of labour offshore sites. This form of labour arbitrage initially saw substantial benefits in reducing operating costs. In recent years however, the cost of off-shore labour has risen due to high attrition rates amongst workers leading to increased wage demands in these jurisdictions. Now the benefits from labour arbitrage have likely bottomed out and could even be declining. Financial Services Enterprises are amongst those that have traditionally benefited from outsourcing but, as with other types of Enterprises they are increasingly looking for new ways to reduce operating costs. Even where Enterprises have already outsourced their operations to offshore sites, they should press their outsource providers to demonstrate how they plan to integrate IPA as a solution to continue overhead cost reduction.

Conclusions and next steps?

The benefits and advantages of this type of technology are clear. What is less straightforward is how an Enterprise goes about the discovery, assessment, implementation and performance evaluation of this type of technology. There is currently a glut of software vendors all claiming to offer IPA software, robotic automation, cognitive and self-learning artificially intelligent software platforms. However, Enterprises need to be very careful about how they approach this technology. They should be very clear about the business problems they wish to solve, and be extremely exacting about the Vendor or Vendors they chose to use. Best practice typically requires full assessment of business processes prior to automating them. As with any product being used within Financial Services due diligence should be completed to ensure selected solutions are robust. Quantitatively evaluating the value realised as a result of any implementation should also be an integral part of any Digital Transformation programme.

Clients can follow a Digital Transformation Assessment DTA approach with Actual Intelligence to assist them in selecting solutions and Vendors. In the case of Intelligent Process Automation software, we can assist clients by managing a Proof of Concept [POC] exercise for them. This will test the technology and can achieve buy-in from the rest of the Enterprise based on the actual value the POC delivered.

Intelligent Process Automation will undoubtedly become an integral part of the future operating models of Professional Services Enterprises and fully automated business processes will be realised over time. The experiences of each Enterprise’s journey of how they get to that end state model will of course differ significantly. With the application of knowledge, research and planning combined with appropriate levels of due diligence, Enterprises will help to ensure they select the optimum path to Intelligent Process Automation.

Blockchain

Blockchain

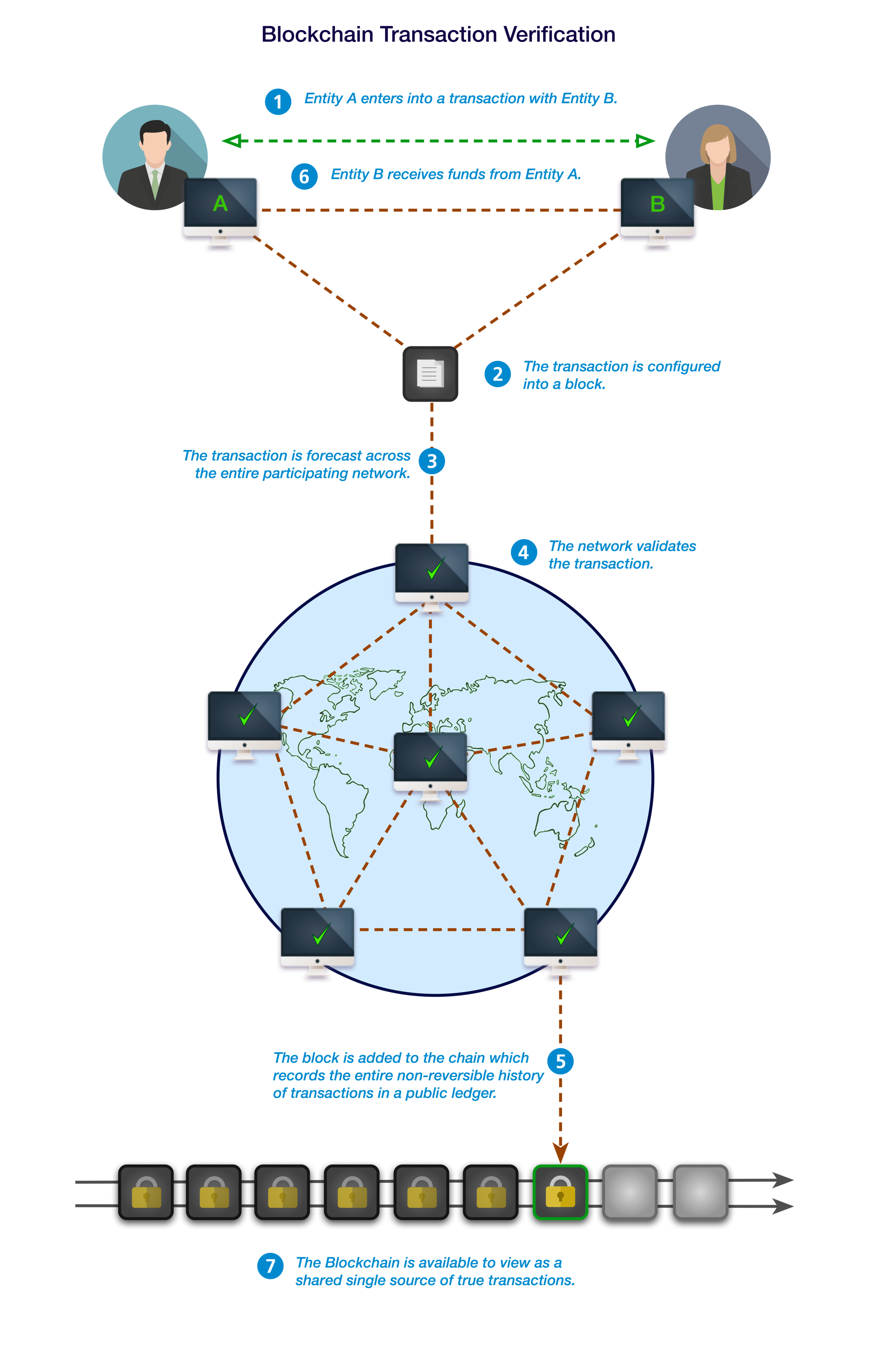

A secure and verifiable, distributed general ledger that records the provenance of the ownership of assets in a shared, sequential transaction database.

Blockchain was designed for and is still used as the underlying technology of the Bitcoin currency. Blockchain technology enables the Bitcoin currency by ensuring the secure and verifiable transfer of currency between entities without the use of third-party, regulated clearing institutions, i.e. Banks. Although the Bitcoin currency has in the past courted controversy due to its association to black market activities, the theory of the underlying technology that is Blockchain is sound, proven and shouldn’t be discounted as a result of its historical misuse. Blockchain technology has been around for a number of years but in recent times Enterprises, especially Financial Institutions have come to realise that this technology could be adapted for use within Financial Services with a potentially massive transformative effect.

What are the potential uses of Blockchain within Financial Services and what are the perceived benefits?

It is true to say that Blockchain has got many people within the Financial Services Industry very excited about its range of potential uses. The technology could either be applied to existing operating models to achieve business outcomes more efficiently or, have the potential to completely re-engineer existing business processes in order to achieve previously unattainable business outcomes.

Blockchain could be applied to many transactional business processes and act as a replacement for Intermediaries in Dealing, Clearing and Settlement. Much of the infrastructure in our industry today is based around the concept of using Trusted Third Parties to clear transactions. Legacy systems have been built in response to this system of processing transactions between Investor, Buy-Side and Sell-Side entities. The use of third-party clearing institutions means that the processing of transactions has many links in the chain which equates to slow processing times high processing costs.

Should we see a universal uptake of Blockchain or ‘Blockchain like’ technology, processing times to clear transactions could easily be reduced. Existing cycles of T+2 or more would be transformed to near instantaneous settlement. This would not only make for a more efficient market. It would reduce the need for and indeed the cost of, the associated back-office operations required to Confirm, Settle and Reconcile transactions and positions. Financial Institutions would benefit from reduced operating costs and a reduced capital requirement associated to near instantaneous settlement.

The benefits from this technology are clear when we think about its application to processing transactions in 'vanilla' securities. Additionally however, this technology could be applied to more exotic security types that have historically been more time consuming and costly to process. For example, Blockchain could by-pass the requirement to clear Over-The-Counter (OTC) Derivative transactions through Central Counterparty clearing houses (CCPs) or, enable Asset Managers to trade relatively illiquid securities with each other directly.

As well as the obvious benefits from reduced operating costs and improved processing times, Blockchain will streamline associated processes. Administrative functions such as oversight and compliance would also benefit. For example, AML and KYC requirements could be centralised and streamlined. Allowing Regulators unfettered access to the Blockchain would encourage more accurate monitoring and compliance and this would in turn reduce the administrative burden on Financial Institutions to meet regulatory reporting requirements. From a wider international markets perspective, the technology would enable National and Supranational Authorities to have a more accurate view and oversight of systemic market risk.

Key considerations and challenges of the technology

Without doubt the widespread adoption of this technology across the multiple linked players in Financial Services is the main consideration as to the speed of uptake of this technology. Although the benefits are clear, it will require a substantial change to multiple operating models to unlock them. Clearly Blockchain is not going to be universally adopted overnight. Quite how long it will take to attain consensus on Blockchain is probably the biggest challenge facing its development. It will take time to develop and test the technology and gain industry consensus. That said, many of the large Institutions on the Sell-Side are already involved in Blockchain initiatives. These range from proof of concepts, to building technology to solve specific problems to participating in industry wide initiatives and forums. The momentum generated by some of the leading Institutions combined with the promise of reduced operating costs means widespread adoption appears inevitable.

What is surprising however is the lack of action from Transfer Agents and Clearing and Settlement Houses as seemingly, they have most to lose from the universal adoption of this technology. Should Blockchain become generally accepted, it’s introduction would have a very serious impact of the ability of these Institutions to generate fee revenue for their Dealing, Clearing and Settlement services.

An additional concern surrounds accountability. Blockchain is a shared technology and should there be malpractice, Regulators would need to have a defined owner with which to remonstrate. The concerns around the ledger being publicly shared are being addressed through the concept of a ‘Private Blockchain’, this is where only the participants in a given network would have access to the ledger. This has also given rise to the concept of a ‘Hybrid Blockchain’ where the core of the ledger is private but certain elements can be made more publicly available, for example where a ledger is opened up to Regulatory Authorities.

Conclusions and next steps

Blockchain will undoubtedly bring huge benefits for some Financial Services companies and be detrimental to the revenue generating models of others. Clearing and settlement houses will need to adapt and incorporate Blockchain as failure to act will see them lose market share or render elements of their business obsolete. Blockchain and similar technologies will vastly reduce transaction costs and settlement times. These are the stable of some Institutions’ revenue but a direct cost for other institutions. In an environment where fee margins are being almost universally squeezed, every Institution will be looking to this technology to reduce its operating costs. Although we are a little way off from mainstream adoption of Blockchain, as a minimum, Enterprises should be considering the impact of this technology and starting to plan for its integration in IT strategies and change initiatives. They should also be actively involved in peer group and industry initiatives as well as monitoring what their Suppliers are doing to incorporate this technology and pass on any associated cost savings.

Robo-Advisers

Robo-Advisers

Accessing the mass affluent through online platforms that provide investors with automated investment advice based on their individual, self-determined investment goals and risk profiles that creates a bespoke wealth management service at a very low cost.

Robo Investing is the use of automated risk management algorithms to arrive at investment decisions to construct a portfolio of investments for a retail investor. The construction of an investment portfolio is generated based on a series of investment goal and risk profiling questions answered by the investor through an on-line front end platform. Portfolios are typically made up of passive investments, normally ETFs. Providing automated investment advice is designed to provide benefits including cost savings and low minimum investment thresholds to the investor. The investments in the portfolio are automatically rebalanced to keep in the bounds of the individual investor’s investment goals and risk profile.

What are the Benefits?

So far we have seen this service being offered by start-up companies hoping to disrupt the wealth management landscape as well as offerings from existing legacy Asset Managers. Whether start-up or legacy player, both groups have so far gathered substantial assets under management and this form of investing clearly appeals to retail investors. There are four main reasons for this:

1. Low Cost of Investing – by automating large parts of the investment process, and by investing in ETF’s, providers are able to offer a bespoke wealth management service to investors at a very low cost. Annual management fees are also kept low due to the benefits of automation and the compounded performance effect of low fees is marketed as an investment advantage to the investor.

2. Low Minimum Investment Amount – prior to this service being offered, if investors wanted a wealth manager to manage a portfolio on their behalf then the minimum investment amount required was traditionally quite large. The reason for this is the high overhead costs associated to the business models of traditional wealth managers. This was due to a relatively expensive, manual, human based, approach to investment advice and the associated investment process. Typically, a traditional wealth manager might have a minimum entry amount of c.£250k, whereas an investment portfolio through a Robo-adviser can have a minimum entry amount as low as c.£1k.

3. Management Convenience – investors' portfolios are automatically rebalanced at regular intervals on their behalf by the provider to ensure their portfolio remains consistent with their investment objectives and risk profiles.

4. Customer Experience – access to investment advice through these digital platforms is often perceived by investors as being more modern and convenient. Rather than a time consuming and expensive face to face meeting with an investment advisor, investors are able to participate in the investment process and monitor their portfolio at their convenience. Additionally, investors have the ability to set up regular contributions by direct debit or, to instruct ad-hoc contributions or withdrawals. All this can be done at their leisure either on-line or through mobile apps.

So what does this mean for Asset Managers?

Following recent UK legislation around RDR, retail investors have been more reluctant to pay for investment advice. As a result, investors have tended to hold cash rather than purchase investment products. Robo-adviser platforms are proving to be a convenient solution to this problem for Investors and a popular way for Asset Managers to connect with new customers and gather additional assets. Due to the low minimum threshold amounts and low management costs, Asset Managers can now access and service the ‘Mass Affluent’ Investor market in a cost effective manner. Investors seem to like Robo-adviser platforms. They can utilise tax efficient investment vehicles such as ISAs and Pension Fund allocations and this in turn represents additional revenue channels for Asset Managers. Fund houses are now able to win a share of the fees that traditionally went to financial planning advisers. Low cost investment services through mobile digital platforms are additionally attractive to Millennials who remain a relatively untapped client base. Gaining market share amongst this generation can be very advantageous for Asset Managers. Clearly customer loyalty still exists whatever the generation, so having a Robo-advisory presence and not missing out on unharvested assets is extremely important for any Enterprise’s future success.

How Robotic is ‘Robo’?

Although the term Robo-adviser is used generically, it is worth pointing out that the automated robotic elements differ between providers. Some are fully robotic and some are made up of a Robo/human hybrid platform. Often the front end interaction with the Investor tends to be fully robotic but, the back office and dealing of investments can be robotic, human or, a Robo/human hybrid model. Most providers have a call centre helpdesk operated by human workers should they be required. The core investment management decisions continue to be managed by human workers. Although, as this is an evolving model, it may not come as a surprise that at some point in the future, elements of the core investment management process will be automated.

Conclusions

Whether start-up disruptors or legacy Asset Managers, all of the platforms launched so far have gathered significant amounts of assets. The disruptors have picked up and connected with a sector that was previously not being very well serviced, the mass affluent. The key point being that through the application of automated technology and associated low costs, both Investors and Providers stand to gain from the investment process. The real success stories however, have been from the platforms launched by established names, Vanguard’s Robo-advice platform reportedly* grew to run $32bn of advisory assets by the end of its first full year. This indicates that an established and trusted name still curry’s favour with Investors. Indeed, Blackrock, Fidelity, Deutsche and Invesco are all planning to launch or, have recently launched platforms of their own.

Next Steps

So how should Banks and Asset Managers take this forward? Does it make sense to build a Robo-advisory platform from scratch or, would joining an established platform be a better option, thereby taking away technology maintenance overheads? Alternatively, some Financial Services Enterprises have opted to acquire platforms from start-up companies, Blackrock bought ‘FutureAdvisor’ in August 2015. Ultimately, how Enterprises progress should be carefully considered. Actual Intelligence can assist in the assessment, implementation and evaluation of Robo-advisory platforms to help clients unlock the potential gains from this new revenue channel.